Perfect Info About How To Become S Corporation

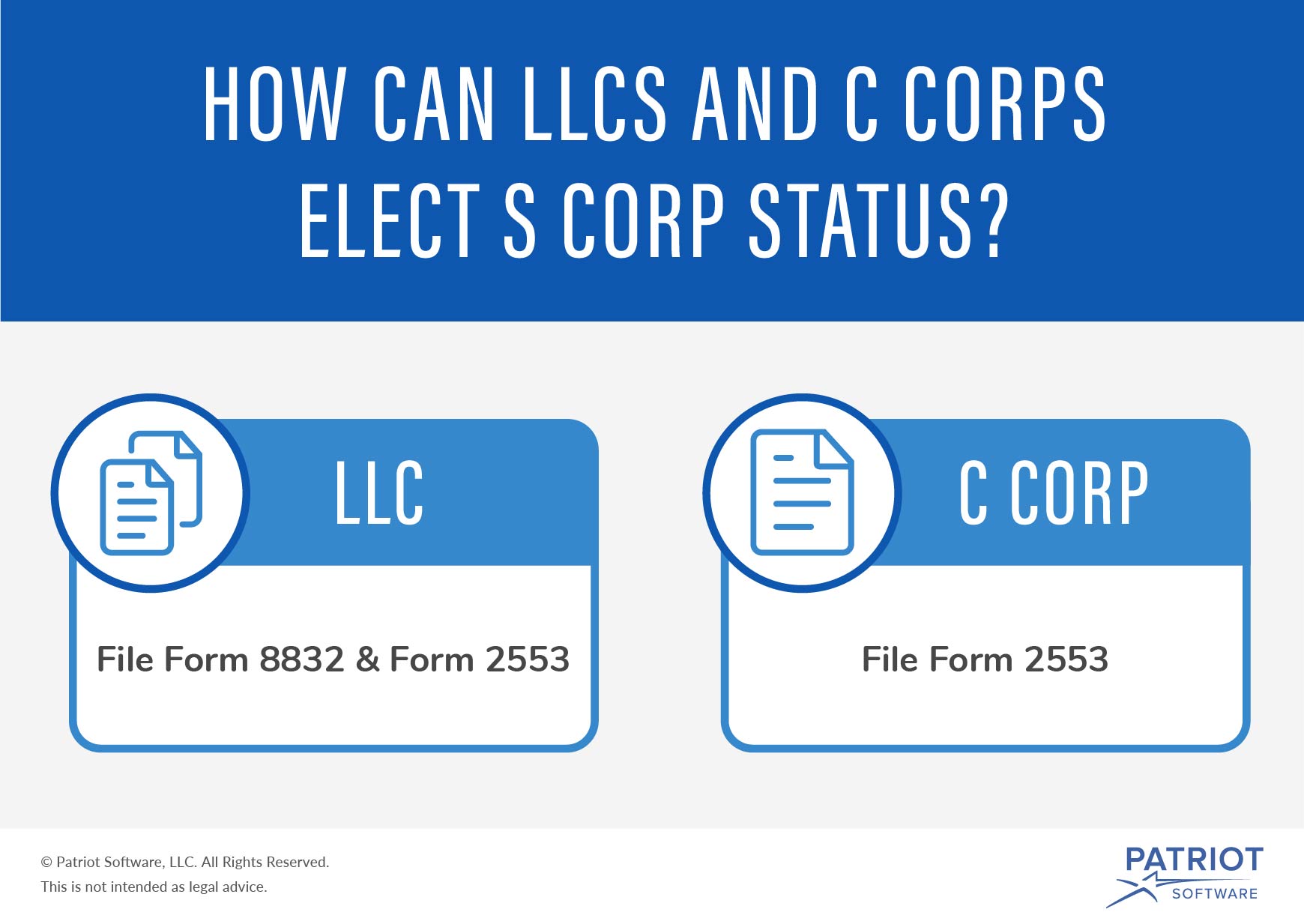

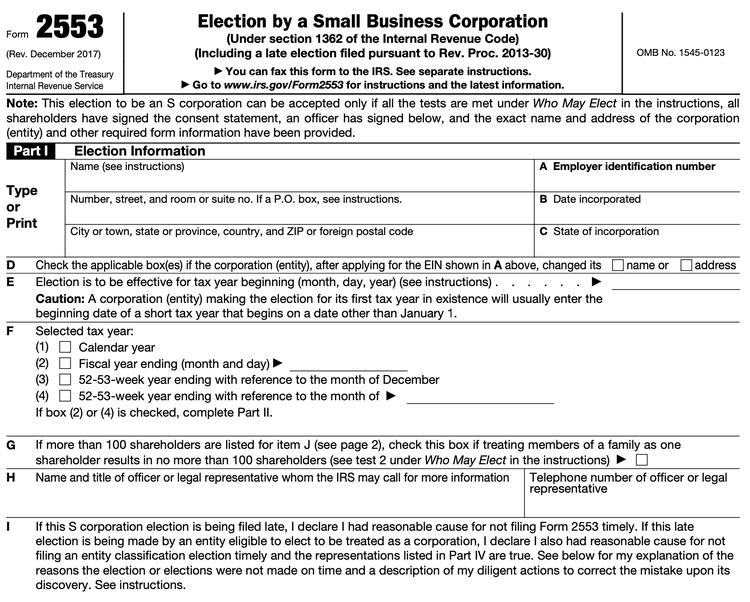

In order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders.

How to become s corporation. If the corporation has a valid subchapter s election granted by the internal revenue service and is doing business in south carolina, the s corporation income tax return (sc1120s) must be. To prepare our students to become successful members of the global community. Ad file your s corporation today.

Ad have plans to get investors & go public? Corporations provide limited liability defense for. Once you’ve determined you’re eligible, electing s corporation status isn’t as complex as it may seem.

The shareholders must agree in writing to the election to be an s corporation. Over 500,0000 filings since 2004. In order to qualify for s corporation status, the corporation must have no more than 75 shareholders.

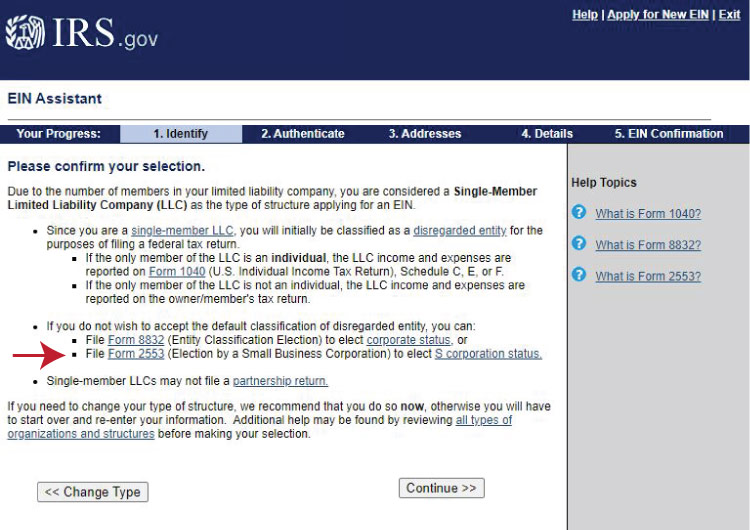

At this time, they can also put in a request to change to an s. S corporations are subject to the annual $800 minimum franchise tax; In forming a corporation, prospective shareholders exchange money, property, or both, for the corporation's capital stock.

The corporation can have no more than 75 shareholders with a husband and wife. To become a small business corporation, the irs has several special requirements including: Protect your business from liabilities.

A corporation generally takes the same. Here are the requirements that your company should. You must file form 2553 within the first two months and fifteen days.

:max_bytes(150000):strip_icc():gifv()/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)

![How To Become An S-Corporation [Step-By-Step] - Youtube](https://i.ytimg.com/vi/s4-W7OfBH0g/maxresdefault.jpg)