Amazing Tips About How To Find Out The Status Of Tax Return

Individual income tax return, for this year and up to three prior years.

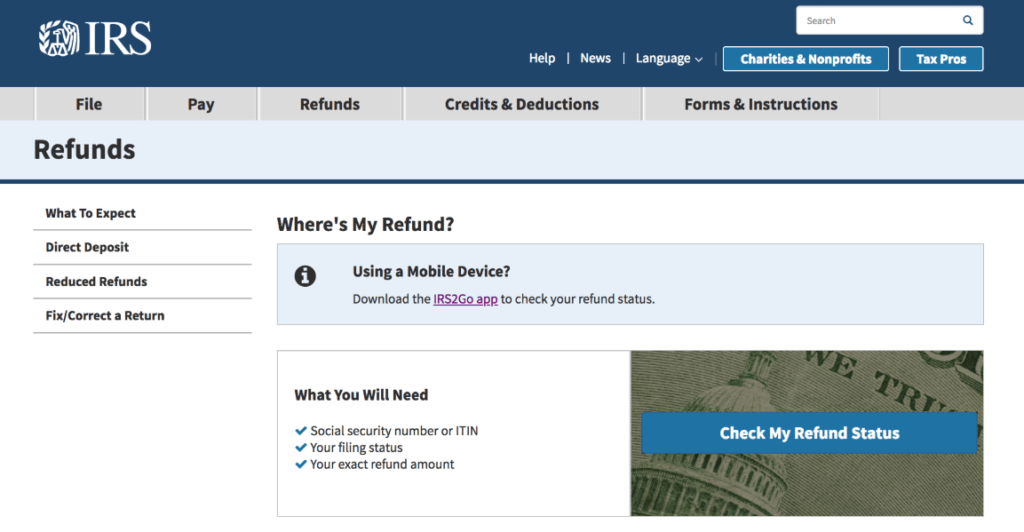

How to find out the status of tax return. On the right side of the page, you will see a link called wheres my refund? Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: Your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct tax.

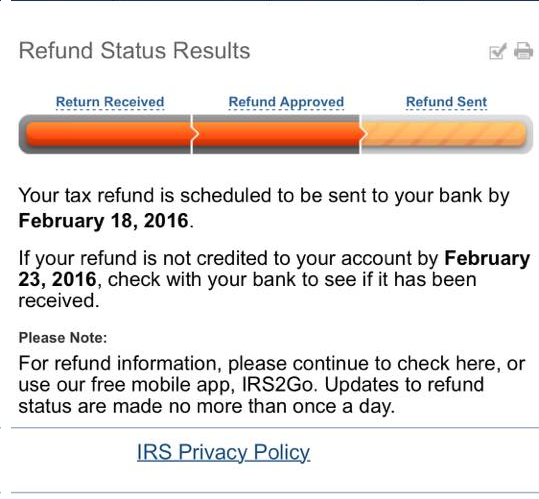

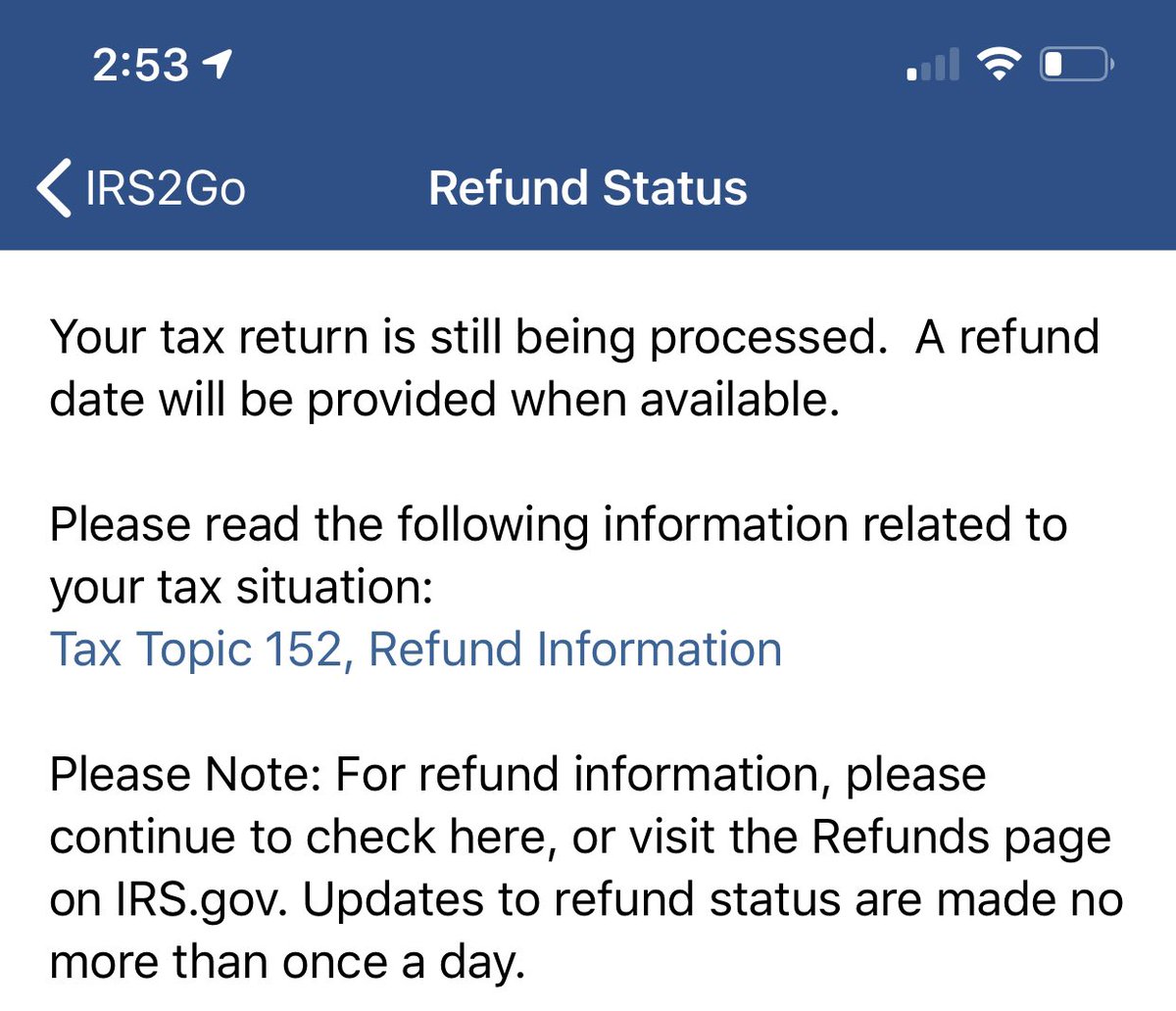

Then select the income year you are checking. March 5, 2019 the best way to check the status your refund is through where's my refund? All you need is internet access and this information:

To find out, visit the irs website. From the home page select manage tax returns; You can start checking on the status of your refund within 24 hours after the irs has received your electronically filed return, or 4 weeks after you mailed a paper return.

Baler's office said friday the 13% is a preliminary estimate and will be finalized in late october, after all 2021 tax returns are filed. to be eligible, you must have paid personal. Full name and date of birth; Check on your state tax return by visiting the west virginia state tax departments website.

If you don't have a mygov account, it's. To check the status of your personal income tax refund, you’ll need the following information: Using the irs where’s my refund tool viewing your irs account information.

You'll need three pieces of information: If you used a different online tax. The status shows how your tax return is progressing.