Lessons I Learned From Tips About How To Apply For Tax Return

If you cannot complete your return on time you need to apply for an extension of time.

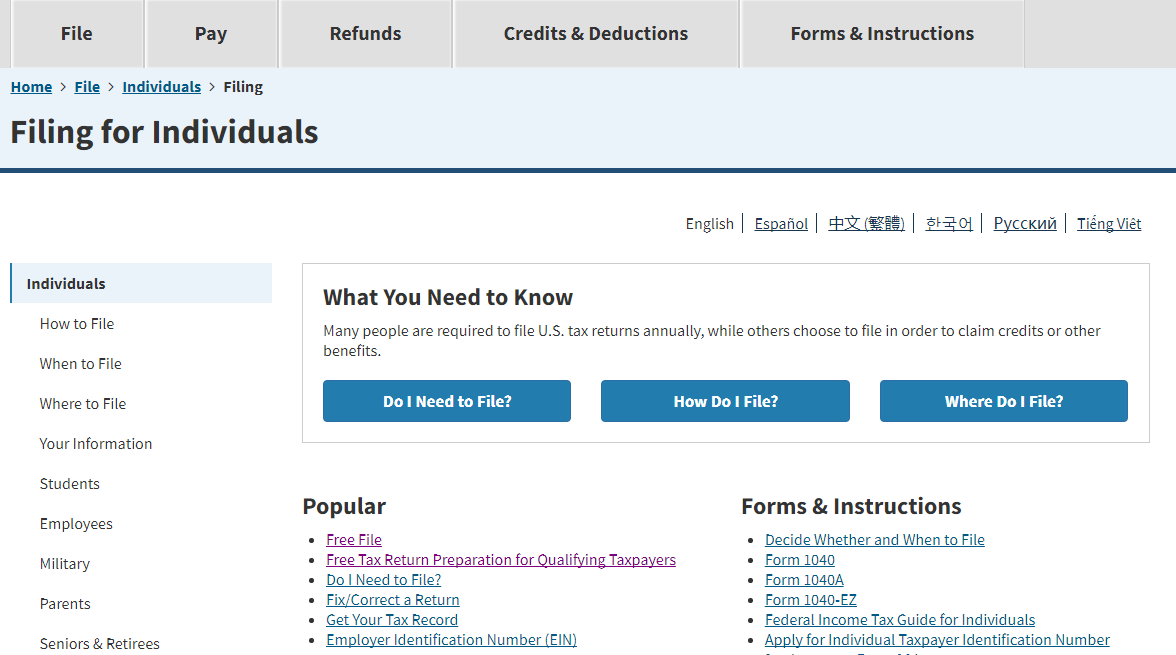

How to apply for tax return. Use this service to see how to claim if you paid too much on: Although the announcement noted that an application for borrowers to apply for the program would be. Applying for tax exempt status.

To pay tax, you'll need to register for self assessment. Ensure your bir number is included in the. The local tax is due monthly, with returns and remittances to be filed on or before the 20th day of the month for the previous month’s sales.

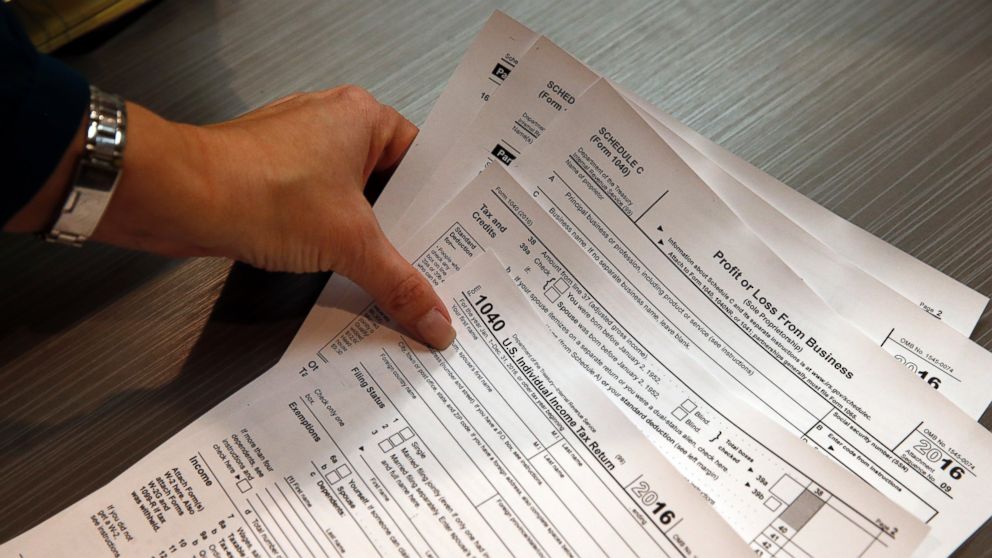

If you need to submit an income tax return, you can complete and submit it to sars via the following channels: Look at your payment history. You may be able to get a tax refund (rebate) if you’ve paid too much tax.

Send us your return by 7 july unless you have a tax agent or an extension of time. Your refund will be automatic if your income is from: Verify that you meet the income threshold by checking your 2020 and.

The local consumers use tax is due monthly, with returns and remittances to be filed on or before the 20th day of the month following the month in which the purchase was made. See your prior year adjusted gross income (agi) view other tax records. Your tax return is a form you can complete online or by paper, get help from a tax agent or our tax help program.

Employment (such as salary and wages) investments (such as interest or dividends under $200 from bank deposits or savings) an. Pay from your current or previous job. Visit or create your online account.

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22238649/Screen_Shot_2021_01_15_at_2.52.29_PM.png)